Surepayroll hourly calculator

Not sure if SurePayroll or Hourly is the better choice for your needs. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

How To Apply Holiday Pay To Payroll 2021 Year End Tips And Tricks Surepayroll Youtube

This federal hourly paycheck.

. Taxes Paid Filed - 100 Guarantee. Multiply your rate of pay by decimal. This is your total income subject to self-employment taxes.

Where did you hear about us. Welcome to our free business and payroll calculator page. There are also 24 hours.

To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year. Taxes Paid Filed - 100 Guarantee. Hourly Paycheck Calculator quickly generates hourly net pay also called take-home pay free for every pay period for hourly employees.

This is calculated by taking your total net farm income or loss and net business income or loss and multiplying it by 9235. You can also use the calculator to calculate hypothetical raises adjustments in retirement contributions new dependents and changes to health insurance premiums. Ad In a few easy steps you can create your own paystubs and have them sent to your email.

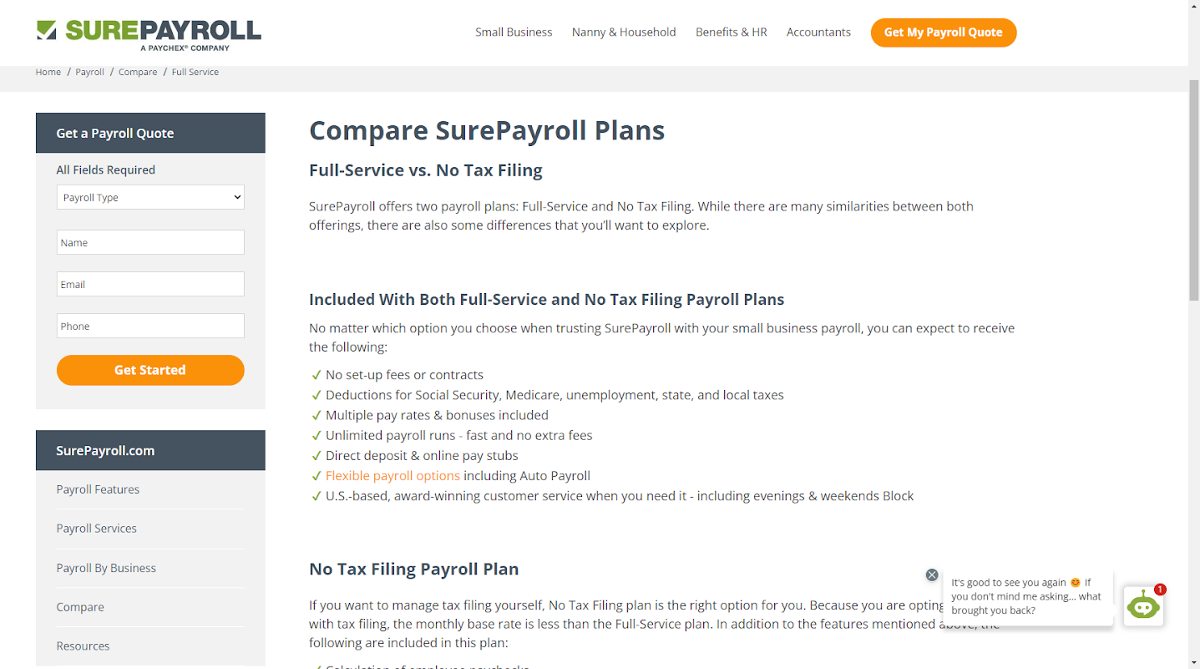

We use the most recent and accurate information. Special Offer for SurePayroll Customers 2500 off any Virtual TimeClock software license. Whether a business has 1 10 or 100 employees Small Business Payroll by SurePayroll delivers peace of mind by combining award-winning US-based customer care and.

The average SurePayroll salary ranges from approximately 59416 per year for a Customer Service Representative to 82693 per year for an Account Executive. Check Capterras comparison take a look at features product details pricing and read verified user. An hour is most commonly defined as a period of time equal to 60 minutes where a minute is equal to 60 seconds and a second has a rigorous scientific definition.

S21 ultra exynos vs note 20 ultra exynos. If you arent currently using payroll software and have just a few hourly employees the free hourly paycheck calculator below can help you determine how much to withhold from. Ad Easy To Run Payroll Get Set Up Running in Minutes.

So 41 hours 15 minutes equals 4125 hours. For example if you earn 2000week your annual income is calculated by. Normal synovial fluid color.

Ad Easy To Run Payroll Get Set Up Running in Minutes. How to calculate the Employee Retention Credit. 1560 025 Add your whole hours back in to get 4125 hours.

FREE TRIAL LEARN MORE SurePayroll Virtual TimeClock Special Offer Payroll just got a lot easier. If their income exceeded 106800 the FICA tax savings would be limited or zero. Skip To The Main Content.

In this example your partial hour is 15 minutes. In addition to our. A paycheck estimator can estimate the amounts to be withheld from the employee for payroll taxes or any other deductions that may apply.

Create professional looking paystubs. The term paycheck refers to the wages an.

Surepayroll Review Great For Small Businesses And In Home Help

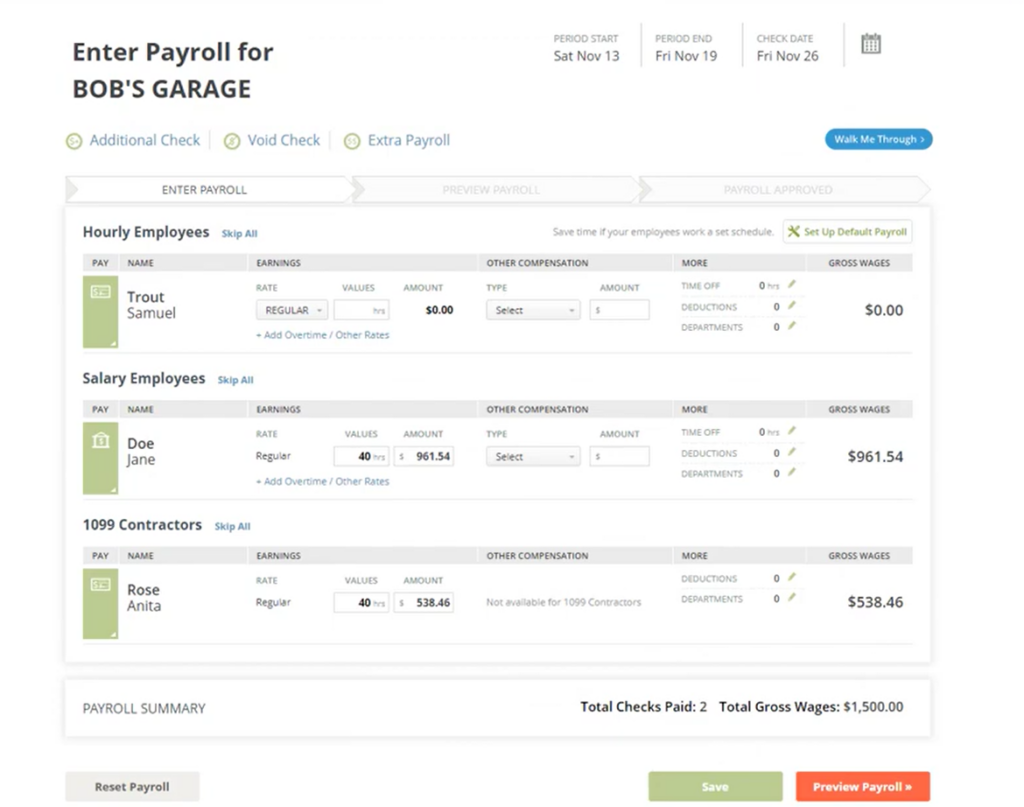

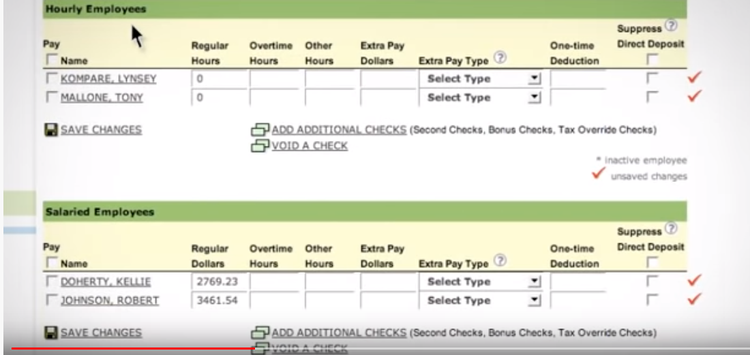

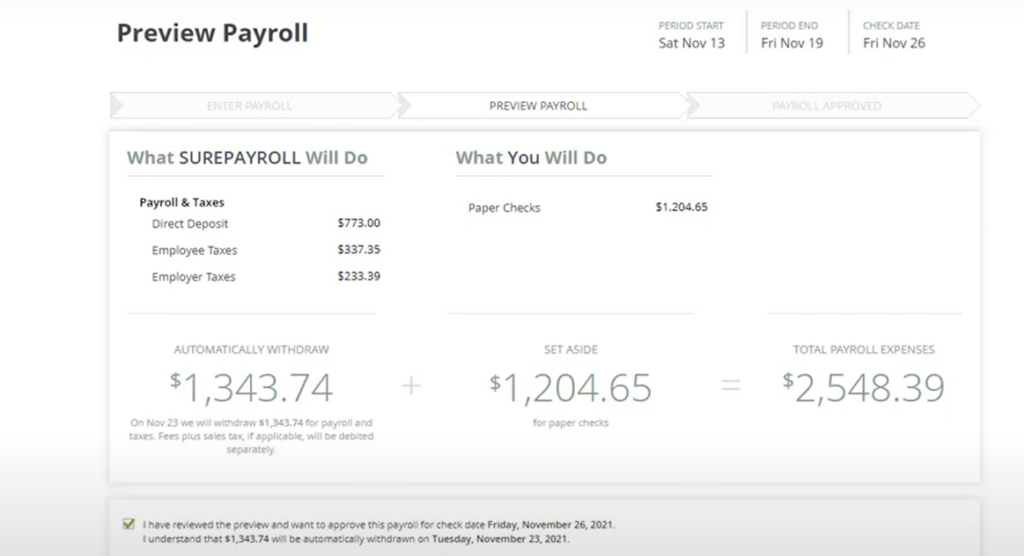

Surepayroll Review 2022 Features Pricing More

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

Surepayroll Review 2022 Features Pricing More

The Best Online Payroll Services For 2022 Pcmag

Surepayroll Review Business Org

Surepayroll Review 2022 Pricing Ratings Comparisons

Surepayroll Review Great For Small Businesses And In Home Help

Surepayroll Review Great For Small Businesses And In Home Help

Surepayroll Review Great For Small Businesses And In Home Help

Gusto Vs Surepayroll Which Is The Better Payroll Solution For You

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

Surepayroll Review Pricing Comparisons And Faqs

Surepayroll Review 2022 Pricing Ratings Comparisons

![]()

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

How Many Pay Periods In A Year Biweekly Pay How Many Paychecks In A Year